Customs Aliexpress that you can and what can not be pronounced through customs

When ordering goods with Aliexpress Before many, the question becomes, but how can the customs clearance go. How many things can be transported for free, and what are the customs rules of our state. We will try to answer these and other questions in this article.

Contents.

- Customs features, what tasks are performing customs

- How the customs duty is charged if the limits are exceeded

- Delivery of bulky goods, how duty is calculated

- Express delivery with Aliexpress, as Customs is issued, why the buyer is asking for passport details

- How not to pay customs duty

- Cargo cargo major batch of goods and large-sized goods

- Which products will not miss customs

- If the goods detained at customs, what to do

Customs features, what tasks are performing customs

Customs Service Our country is the executive body and subordinate to the Ministry of Finance. According to the government decree, the following functions are assigned to it:

- drawing up lists of persons and firms in the field of customs law (intellectual property, customs representatives);

- provision of certificates and permits to carry out activities in the fields of customs;

- establishment of the procedure and implementation of customs control;

- classification of goods according to the nomenclature of foreign economic activity, also determining the country of origin of things passing through the border of the country;

- preventing crimes and violations in the field of customs law;

- consultation of citizens on the declaration and transportation of goods.

In addition, this service is charged with customs fees and duties entering the budgets of countries. The customs service is guarding about the order and fully controls all the movements of things through the state border.

customs rules, import to Russia

When entering goods to our country exist certain rules Customs installed. If the price of things is more than 65 thousand rubles and the total weight is 35-200 kg, then everything is more complete will have to pay according to the rate of 30% of the customs value of the goods. Moreover, this price should be at least 4 euros per 1 kg of cargo. If a person imports tobacco products into the country and alcohol his age should be not under eighteen years. Moreover, it is possible to carry three liters. When importing 4 liters will have to pay a fee of 10 euros. Moreover, more alcohol must be declared to not be seized. Also, many are acquired abroad seeds of plants or animals.

For their import, appropriate documents are needed:

- act of phytosanitary control of civil service for quarantine plants, certificate of the Ministry of Nature;

- veterinary Certificate of State Veterinary Supervision, Certificate of the Ministry of Nature.

Knowing this information, you can calculate the amount of imported goods and protect yourself from trouble when customs control pass.

customs rules of Ukraine

Customs regulations This country is fairly loyal and aimed at ensuring the safety of citizens of this state. But in the current year they were tightened and all entering and the goods crossing the border carefully examined. When importing goods into the country's territory, their list is clearly registered and certain quantities are indicated.

To Ukraine can be imported:

- things worth up to 200 euros and weighing up to 50 kg;

- strong alcoholic beverages in the amount of 1 l, the wine is allowed to import 2 l, and beer 5 l;

- tobacco products can be imported in the number of two hundred pieces (cigarette block).

These items can be quiet, the main thing is that they are in personal baggage.

As for food, it can be imported as follows:

- product in the factory packaging weighing no more than 2 kg;

- without packing weighing 2 kg;

- product without packing not subject to division.

All this is given per person. When the customs transitions, there is enough oral declaration, although the employee may ask for everything in writing. You can also import things for personal use (decoration, phone, medicine, stationery, etc.). But they must be strictly for personal use, and not for implementation. With regard to the importation of flora and fauna, the rules are similar to the requirements of the customs service of Russia. Cannot be imported to the territory of Ukraine to poisonous substances, items that can harm people. In these rules, everything is quite clear and will not comply with their special work.

customs Regulations of the Republic of Belarus

The customs service of the friendly of the Republic of Belarus takes all measures to prevent illegal commercial activities. For this, restrictions are entered import of goodsAs well as their receipt of mail.

So, the limits for the duty-free receipt of goods are as follows:

- parcels from other countries should not exceed 10 kg in their weight and stand more than 22 euros based on the course of the National Bank (this restriction is valid for one addressee per month);

- for persons crossing the border more than once every three months, 20 kg worth 300 euros can be imported;

- those who enter the republic with an interval of three months to bring 50 kg of cargo at the cost of 1,500 euros;

- for people preferring the flights of limits, there are no limits, for them is provided for by the rules of 50 kg of cargo at the cost of 10 thousand euros.

These rules apply to all state crossing the border. They may differ from the customs rules of other countries, but rather loyal.

customs rules of Kazakhstan

Kazakhstan is another state with which our country is associated not only by the overall border, but also friendly relations. Many worries the question as can be imported in this state and in what quantities. Consider the number of goods that does not require payment of duty and declaration (for personal use).

These include:

- clothing two things of the same name, shape and size per person;

- bed linen couple of sets of one type per person;

- carpets in two subjects;

- headdresses Two things of the same size and style for one person;

- shoes are similar to clothing and head removers;

- products of their skin and fur one subject per person;

- food products at the rate of 10 kg per person;

- phones tablets, laptops 2 pieces per person;

- perfumery and cosmetics Three units per person;

- jewelry products 5 items per person.

It should be noted the following that these requirements do not apply to goods used in use, and sent by postal services and commercial companies for individual use. Now you have full information on the importation of goods and postal shipments in the territories of neighboring countries.

How the customs duty is charged if the limits are exceeded

Ordering things on Aliexpress We do not think about how much you need to pay for shipment, customs clearance and insurance. Usually all these amounts are laid in the price of things and when delivering such a departure, the recipient pays only customs payments. There are certain factors that may affect the price of the departure itself.

Therefore, it is necessary to take into account a number of comments:

- the parcel price is announced by the sender and is affixed in the appropriate collateral column;

- all payments are charged from the customs value of things, they also include transport waste which can vary from 6 to $ 20 per 1 kg when delivering by courier service;

- initially, the low cost of departure may cause suspicion of customs workers, and they can change it upwards;

- with a valid low order price, it will be advisable to invest a check or any other confirmation of its value;

- do not specify the price of goods in the graph, which is a gift, it will significantly detain the design of the parcel and will increase customs payments.

Since 2010, identical billing rates have been established that do not depend on the organization of the processing parcel. Rules for public mail and commercial carriers have become almost the same. When the weight of the departure does not exceed 31 kg, and the price of 1000 euros customs payments are not required. If one of the points is excess, it is necessary to pay a fee in the amount of 30% of the cost of goods, at least 4 euros per kilogram of weight.

Consider the calculation of duties on two examples:

- The weight of your parcel is 34 kg and its price is 500 euros. At the same time, you will have to pay a duty that simply calculate: (34-31) * 4 \u003d 12 euros.

- Sending 20 kg weighing is worth 1400 euros. In this case, the duty will be calculated as follows: (1400-1000) * 30% \u003d 120 euros, because The cost of goods exceeds the amount of restriction.

Now you can independently calculate the cost of customs expenses if necessary.

Delivery of bulky goods, how duty is calculated

Frequently people order quite large things. For example, on Aliexpress You can order a sofa. But how many will have to pay for it this question almost immediately arises before the buyer. So consider in more detail this case. The buyer acquired a sofa on the site at a price of $ 500 and weighing 40 kg. The stated shipping cost is $ 180. Total cost of the thing is $ 680. Next, it is necessary to find the product code according to the commodity nomenclature of the Customs Union, it can be found on the website of the customs service of each country. To do this, we find the appropriate section and group. In our case, this section number XX and group 94 (furniture, bedding, lighting devices, etc.).

Next, in the opened table we find the code and the value of the customs rate for this item. In our case, the code 9401400000, and the duty on it is 15% of the cost, but at least 70 euros of the cents per 1 kg.

The excise tax is not charged, but VAT (value added tax) will have to pay in the amount of 18%.

Knowing all the source data can be calculated by the duty:

- 680 $*15%=102 $,

- 40 kg * 0.7 euro \u003d 28 euros.

From these numbers, the largest is chosen, it will be your duty. It remains to calculate VAT 680 $ + 102 $ \u003d 780 $, 780 * 18% \u003d 140.76 dollars. Ultimately, the design will cost 102 + 140.76 \u003d $ 242.76. When ordering such a product from Ukraine will have to pay VAT in 20% and 10% of the amount of exceeding. In this case, it will have to pay 159 euros as customs fees and taxes.

Express delivery with Aliexpress, as Customs is issued, why the buyer is asking for passport details

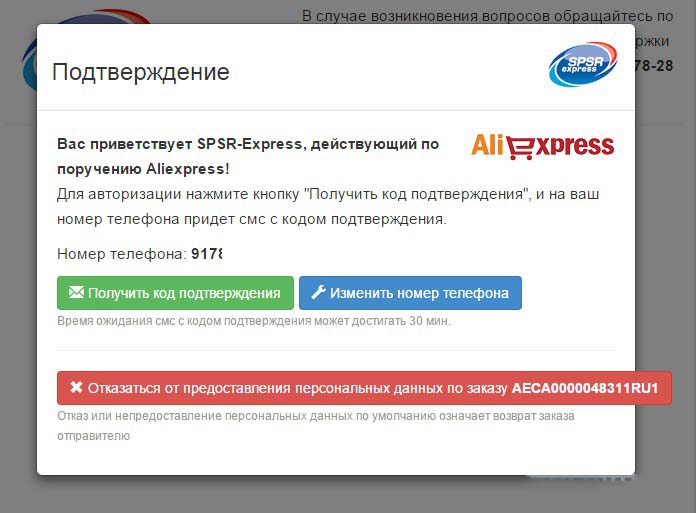

Until recently, for absolutely all types of delivery of goods with Aliexpress There were uniform standards of customs. Unfortunately, for the services carrying out express delivery, these measures have been canceled. Therefore, they are forced to carry out orders across the border on the general reasons. In this case, there is a need for recipient's passport data. Do it safely. You should not be afraid of information leakage, in each company there is a policy of non-disclosure of information. Yes, and scammers to arrange such a confusing scheme. Therefore, you should not worry, and quietly provide information to the supplier. Now the following question arises as data transmission. Everything is simple here. After payment of the order for your email, a letter will come with a notification of the delivery method and a request to fill out your data. A link is usually attached to the letter by clicking on which you will have to fill out a small questionnaire. That's all, now it remains to wait for your thing.

How not to pay customs duty

Each person joining goods across the border wants to save money on customs duty. Name not to pay it. And few knows that this requires comply with the following requirements:

- All things should be designed for personal use or for relatives. This includes household appliances, electronics, clothing. In other words, ten tablets will clearly cause suspicion of customs officers.

- Luggage weight should be no more than 50 kg.

- The total cost of goods should not exceed one and a half thousand euros with a terrestrial border crossing and ten thousand in the same currency with its air intersection.

By completing these requirements, you do not have to pay a duty. In violation of customs rules to threaten administrative responsibility in the form of a fine. When you try to import unresolved things, their confiscation occurs, provided they were for declared.

Cargo cargo major batch of goods and large-sized goods

Many entrepreneurs buy large parties of things in China and transport them to their homeland. Make it yourself practically unreal, because You can not deal with all documents, and I will take a lot of time. Therefore, you can use the help of special cargo companies. They are transported by part of goods from 30 to 200 kg by various types of transport. Delivery time is usually 1-4 weeks. The positive side of this method is a small number of documents for the transport of cargo, which attracts Internet resources. That's all. There is also one unpleasant negative feature, it is a large number of unfair firms. As a result, you can lose the cargo and money invested in it. Therefore, choosing this type of delivery be careful.

Which products will not miss customs

There are a number of things that will not be able to undergo customs, it is:

- alcohol, tobacco and narcotic drugs;

- cultural values;

- weapons and explosives;

- cameras of hidden surveillance;

- plants, seeds and animals;

- biological additives and sports nutrition;

- natural precious stones.

If a person wants to buy something from this list, the parcel can skip on the border, but completely under your responsibility. It is better not to risk and ask the seller to miss your package at customs or it makes no sense to order these things. The conscientious seller owns full information about customs clearance and will answer the questions that have arisen.

If the goods detained at customs, what to do

According to the existing rules, it is the property of a merchant to receive the disposal. It is all responsibility for it. There are situations when the parcel is delayed at customs and it is not sent to the address. Previously, it was enough to open a dispute due to problems with the customs and there was a refund. Now the parcel can wrap for a number of reasons:

- too low price;

- fake;

- no license or certificate;

- the goods are prohibited for export.

And in the latter case, the buyer pays for the dut. If you refuse it to make you commend costs with deduction of delivery. In the situation of aggravation dispute administration shopping ground Asked to present documents (within a week), testifying to non-customs in the fault of the merchant. It is unrealistic to meet in the stated deadlines. Request registration occurs within three days, and the document itself can prepare a month. Therefore, quite often buyers remained without things and money, although the seller was to blame. So, when opening a dispute on the "problem with customs" is not worth a hurry, you must wait for the moment when the order returns a merchant. In this case, he is faster to agree to return the money. You should not immediately exacerbate the dispute, because your mistake can be. In this situation, agree to the refund with the minus delivery. If the seller's fault is obvious, then request a document confirming that the parcel did not miss the dealer. In this case, you definitely meet the weekly provision of evidence in dispute.

This article describes the customs regulations of our country and neighboring states. Examples of calculating customs duties are given, and it is also indicated that it will not be missed during customs clearance. Taking advantage of the tips of the article, you can easily calculate the duty and adjust your order. Enjoy the shopping.